It’s pretty clear now that we’re heading for the mother and father of all recessions. There’s acres of newsprint and online discussion about the whys, wherefores and such, so I won’t repeat it, but I thought it might be interesting to take a look at what I believe this could mean for our gadget obsessed, consumerised world in the near and not so near future.

Of course it’s not the end of the world and we will survive, however it’s obvious that we’re going to have to start adjusting our thinking and expectations in many different ways as we go forward.

1. Welcome to the Era of the Patient Consumer.

Oherwise known as the death of instant availability. As consumers we have become accustomed to retailers, both online and offline, meeting our needs for product quickly. Underpinning this was the old adage ‘consumption is a function of availability’, which meant that retailers had to keep stock on hand for us, or we would go to their rivals and buy there. The credit crisis is changing all that. We are now starting to experience the onset of more and more retailers running a lean and sometimes deliberately out of stock product policy, as a result of a number of factors –

1. Retailers are desperately unloading expensive stocks in order to lower debt and adjust for an expected slump in consumer demand.

2. Retailers are reluctant to hold stocks during a potentially deflationary spiral where prices fall continuously.

2. Smaller retailers are finding it increasingly difficult to finance their stock purchases and transfers with letters of credit because of banking constipation (see below and http://tinyurl.com/a36khg).

3. Freight consolidation is being hit generally by the downturn. (http://tinyurl.com/729yto). If freight is not moving, then smaller retailers cannot take advantage of spare capacity to move their goods from the Far East to their shelves at competitive prices.

I would expect this process of de-stocking to continue over the next few years as retail becomes reluctant (or unable?) to finance our need for instant gratification, and instead starts to demand that we wait. We should expect to start waiting for up to 21 days or more for our products, perhaps on a sliding scale. The cheaper the product, the longer the wait, the more expensive (and therefore more profitable) the shorter the wait. Take your pick. I have personally experienced several situations recently where consumer durables were out of stock in multiple online and offline stores, as they adjusted in this way. Cheaper products were not on the shelves, while a few of their more expensive alternatives were available. I expect this trend to increase.

2. Say Hi to the Factory-Retailer.

One of the biggest casualties of the meltdown is likely to be the traditional retail sector. Not only squeezed by declining profitability, lowered lending and stagnant economies, the traditional retailer is also having to deal with the explosion of online commerce, which is cannibalising and stealing sales away from bricks and mortar. One further aspect to this trend could come in the form of the factory-retailer. We’ve met them before locally in the form of farmer’s markets, and now there’s a strong possibility that we’ll see them rise from the ashes of this crisis via the power of the Internet.

Clever factories around the world, faced with a decimated retail relationship, may well turn to the Internet to ply their trade directly with the consumer. We have already seen the start of this trend with sites such as www.sourcingmap.com, which supplies a wide variety of Far Eastern products direct from the manufacturer’s gates to the consumer at extremely competitive prices. They market themselves like online retailers, operate on-demand for one-off products just like retailers, and interact with their customers in exactly the same way. This is something that is likely to grow and grow.

3. The Death of the Middle Class product.

We may also be about to witness the death of the middle class product. Over the past decades we have seen the consumer retail market stratify into three distinct groups, high quality/high price, middle quality/price, low quality/price. The rise and rise of the debt-fuelled consumer has driven the first two tiers, while the massive availability of cost externalized production (http://tinyurl.com/9laolj) has given us a convenient source of super cheap products at the low end.

Now it looks as though this structure is about to change in a couple of different ways. For one, we’re seeing a contraction in Far Eastern manufacturing which may spell doom to the continuing supply of dirt cheap products. This means that we may return to more accurately priced products which reflect the cost of production more directly. At the same time, there will probably always be a demand for higher priced products, even if the market is much smaller in a credit squeezed society. More durable products with better build quality will always demand a premium price.

The loser in all this looks as though it will be the middle ground, that is those products which offer little discernible value over lower priced goods, and yet don’t have the better quality, long lasting build value of the higher priced goods. These products often rely on marketing or fashion to drive their popularity.

We may shortly start to see the decline of this category of product as the need for more value for money becomes paramount in consumer’s minds. If we have significantly less or no credit to spend, we will be forced to make choices about our purchases, weighing quality against affordability ever more closely, and anything that doesn’t offer a real advantage is likely to be discarded for very practical reasons, no matter what fancy brand or label it carries.

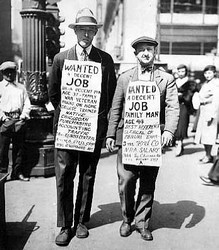

4. The rise of the Make Do and DIY sector.

Another natural correlation with declining purchasing power is the rise of the producer-consumer. This segment of the population has always existed of course; those capable, practical and productive consumers who sew, mend, build and adapt for themselves rather than rely solely on shop bought products. It seems obvious then, that we are likely to see a significant growth in this population as we experience more constraints on our financial capabilities. These prosumers (http://tinyurl.com/2wwkcw), long a glamorous target for marketing managers the world over, will become less of a niche and more of a mainstream segment, demanding more, paying less and covering the difference with their own personal skill sets.

5. Hello to a broken, nationalised and regulated financial system.

Finally, no report, ad-hoc or otherwise, would be complete without reference to the current financial turmoil, and to be blunt, the financial system of old is dead. Finished. Gone. The governments and media of the world may be pretending otherwise, but it’s a fact. We will not return to its like again.

a. Fact One. What drove Finance 1.0 was greed, buddy-buddy trust and risk, and those factors have now gone away from the system. At least for a generation, possibly for ever. At the same time risk is rapidly being replaced by government subsidy. We could call this zero incentive banking, because financial institutions now have no incentive to take risks, and every reason to play safe and accept handouts instead. What this leads to is the current constipation in lending and a crisis in banking. Here is a list of troubled US banks rated by their credit exposure (the Texas Ratio). The higher the number the worse the situation (over 100 = v bad!). This critical contraction of business lubricant is also caused by the fact that –

b. Fact Two. The banks are insolvent. That’s not just my view, last Saturday newspapers in the UK reported the same ( http://tinyurl.com/8gzkuc and http://tinyurl.com/8ln7lo – be aware that the Independent article has been pulled, this is the Google cache, which may also disappear has also disappeared. Full text of the original is here. The key words from the other (Mail on Sunday) article – ‘Experts warned UK banks – traditionally the powerhouse of the economy – are ‘technically insolvent’ and are ‘living on a prayer”). Despite global governments treating the current crisis as a problem of liquidity and pumping trillions of dollars into the system, nothing has really changed, which says that the problem is more severe, and in fact indicates that the banks are really just insolvent (http://tinyurl.com/8yoeqv).

Again this is not surprising, when you remember that Money is Debt (http://uk.youtube.com/watch?v=vVkFb26u9g8) and without a free flowing source of new debt the whole pack of cards collapses under its own weight. It’s no wonder that some eminent economists are now calling for this whole charade to end, and for banks to be nationalised properly, rather thank in dribs and drabs as at the moment (http://tinyurl.com/8yoeqv).

c. Fact Three. The death of leverage has completely changed the landscape for industrial and commercial activities across the world (http://tinyurl.com/8yuzkb). Most of the expansion of global trade was financed by leveraged financial muscle (alongside consumer credit bloat), which has been stripped away in the current crisis. We’re almost certainly not going to return to that level of financial power in the foreseeable future. This means that Business Inc will have to readjust expectations and deliver more modest organic growth for a long time to come, which is something only the better run companies will manage to do.

d. Fact Four. The whole financial system as we know it will inevitably be changed before long. Even if the actors don’t realise it, there is going to be a reckoning for this financial mis-management at some time in the future, and despite all protest, the system will end up highly regulated or nationalised (http://tinyurl.com/8t9g64). The ordinary person in the street will not forget how they have been forced to bail out the greedy profiteers who engineered this debacle, and governments who fail to act on that anger will eventually be removed from power. It may not happen soon, but it will come, once the dust has settled on the present calamity. http://tinyurl.com/7txxem.

Forget about all the grandiose talk of underwriting loans, moving toxic assets to safe harbours and the rest, the fact is that without the housing boom as a credit engine, consumers have become credit averse. Just because you ask me to take on more debt to buy a new car to save the economy doesn’t mean I will. Which means that there is no longer any power driving the wheels, no consumption, no credit, no possibility of growth (http://tinyurl.com/7b6hq5). The 20 year old credit spiral has turned inwards and is eating itself in an orgy of fear and uncertainty. And house prices will continue to fall until they become ‘affordable’ again. Result? A logjam in the financial services industry.

What comes next depends also on a lot of unforeseeable factors outside our control, such as the depth of disruption caused by the unprecedented global nature of the crisis, unquantifiable factors such as oil pricing and supplies and how cataclysmic the possible fission in financial services, banking and the stock markets turns out to be. And we haven’t even touched on the disruption that will be caused by the shift to debt as equity (http://tinyurl.com/8x4zjn), or the potentially staggering socio-economic impact of pension plans destroyed by the financial slump and growing unemployment (http://tinyurl.com/4ofvps).

This then is my personal take on some of the possibilities of the upcoming financial storm for consumers in general. Feel free to agree or disagree. It sounds grim in places, and I don’t pretend to have answers, but if these guesses – which is all they are of course – process out, we’ll face some challenging times ahead. However this situation also offers opportunities to build ourselves an improved society where this sort of thing can’t happen again, which is a silver lining which hopefully will emerge from the pain. As with everything, only time will tell how it all pans out. Interesting times, as the Chinese say.